Wednesday, 31 August 2016

Tuesday, 30 August 2016

Kadar Tukaran Terkini MyFXPrestige (kemaskini: 30.08.2016)

Waktu urusniaga: 24/7 x 365

Kadar di atas adalah untuk transaksi melibatkan urusniaga di dalam Malaysia

For international transactions, kindly contact us at the above-mentioned numbers

or e-mail us at

myfxprestige@gmail.com

Kadar di atas adalah untuk transaksi melibatkan urusniaga di dalam Malaysia

For international transactions, kindly contact us at the above-mentioned numbers

or e-mail us at

myfxprestige@gmail.com

Terma dan syarat adalah terpakai secara non-prejudis

Important Notice: MyFXPrestige Team Main Page Facebook Temporary Inaccessibility

During this temporary period, we will transmit all regular communications thru our official:

Monday, 29 August 2016

Sunday, 28 August 2016

Pick-Of-The-Day: Weekly Performance Report (22.08.2016 - 26.08.2016)

Method : Fibo TuPai 618 Analytics System

Feature : Pick-Of-The-Day

- Monday (22.08.2016)

- Portfolio/ Asset Class : XAU/USD (GOLD)

- Result : Profit 110 pips

- Tuesday (23.08.2016)

- Portfolio/ Asset Class : CAD/JPY

- Result : Profit 15 pips

- Wednesday (24.08.2016)

- Portfolio/ Asset Class : AUD/USD

- Result : Profit 20 pips

- Thursday (25.08.2016)

- Portfolio/ Asset Class : NZD/USD

- Result : Profit 43 pips

- Friday (26.08.2016)

- Portfolio/ Asset Class : No issuance in anticipation of US Fed Chair Yellen speech re Jackson Hole Symposium

- Result : N/A

- Weekly Performance

- Pips-Gain Statistic

- Total Pips Gain : 188 pips

- Total Pips Loss : 0 pips

- Nett Pips Gain : 188 pips

- Total % Nett Pips Gain : 100.0 %

- Analysis Accuracy

- Total Analysis Published : 4

- Total Analysis - Accurate : 4

- Total Analysis - Deviant : 0

- Nett % Analysis Accuracy : 100.0%

- References Link : Please click HERE to view the Trading Journal

How to Combine Technical and Fundamental Analysis

FEATURED ARTICLE

One of the most common questions of new traders is: ‘which is better: Technical or fundamental analysis?’

While technical analysis can be performed on any chart, fundamental analysis, or the study of the actual components of the economy that represents a currency, can be quite a bit more subjective.

If this were a perfect world, we may have a direct and accurate answer to our new trader’s question. Unfortunately reality prevents it from being so. The table will walk through some of the differences of these two breeds of analysis:

Rare is the FX Trader that successfully traverses the terrains of markets with only ONE of these forms of analysis. Most traders have some elements of each comfortably in their repertoire. In this article, we are going to show you how you can do this.

Technicals Help to See What HAS Happened

Technical analysis has a very large role in the FX Market, perhaps even moreso than stocks or futures markets from where this analysis was popularized.

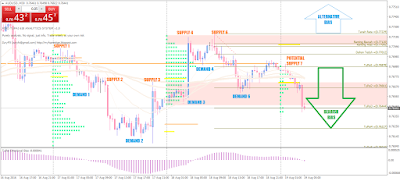

The art of Technical Analysis revolves around analyzing a chart – and strategizing an approach for trading it. There are numerous ways of doing this, and many traders like to include indicators, price action, and a whole flurry of other analytical systems for designing ways of placing trades in the present based on price movements of the past. The picture below shows just some of what traders are looking for in regards to Technical Analysis:

In the above graphic, there are four different mannerisms of support and resistance identified (the same 4 we covered in our How to Build a Strategy series), along with trend identification, and indicators to assist with the risk management approach (‘Average True Range in Pips’ custom indicator). All of these can be associated into the technical setup while arranging a trading plan.

We go over these technical components in the 5 parts of our How to Build a Strategy series. In each of the five component articles in the series, we go into much more depth around that specific subject matter. This is all with the goal of helping traders build an approach based on what has happened in the past with the prices that the asset has actually traded at previously.

This analysis can provide us with a great deal of information, such as being able to read the sentiment that may be on chart, or any biases that may exist. What it will not tell us, however, is the one thing that we most want to know – and that is what will happen next with regards to price. For that, we will need to introduce fundamental analysis into the picture.

Fundamentals Help Shape Future Price Movements

As news releases and additional data filters into the market, traders will accordingly bid prices higher or lower to account for this new information. News releases can often function as a 'motivator' to a market, promulgating future price movements. As such, this leads many to the conclusion that:

News releases can bring considerable volatility into the market, and trading based on fundamentals doesn’t necessarily mean that you need to trade the news.

As a matter of fact, traders can use what they have already built in regards to Technical Analysis to plan an approach around news events. The picture below will explain further:

The primary takeaway in regards to fundamental analysis is that large movements can emanate from each of these releases. And just like we looked at in part 5 of our How to Build a Strategy Series (Risk Management), traders need to know that there is a very real prospect of being wrong, and getting stopped out of the trade. So, for all strategies – it is advisable to trade with a stop so that one trade doesn’t end up doing irreparable damage to your trading career.

Combining Technicals with Fundamentals

Just as we had led off with in our How to Build a Strategy series, traders are often benefited by first identifying the market condition with which they are looking to trade.

For traders looking to trade trends, they want to see a ‘bias’ in the market. This can be done with Price Actionin a very concise manner: For up-trends, this can be a series of higher-highs, and higher-lows; and for down-trends, a series of lower-lows and lower highs. The chart below will illustrate in more detail:

When traders see these types of trends, they are seeing a bias in the sentiment of that market. During a down-trend, that bias is lower – and during an up-trend, the bias is higher. And during these situations, it’s not just enough to buy or sell and hope that we are on the right side of the trade.

Traders should look to buy up-trends cheaply, with price at support; or look to sell down-trends expensive when price is near resistance. Traders can use any mechanism of identifying support or resistance to assist with this process; but is of the upmost importance that traders realize that trends can reverse at any time (much like the above graphic shows a strong down-trend turning into a strong up-trend). As such, risk management should still be used even if it appears that there is a clear bias in the market.

To integrate fundamentals into this approach, the trader can look at the economic calendar as an opportunity to ‘buy cheaply, and sell expensive.’ The trader is looking to take advantage of an overreaction to a news announcement that allows for an opportunity to enter in a longer-term biased market. The picture below will illustrate in more detail:

In the words of our own Jamie Saettele, traders should look to ‘react to the reaction,’ of news releases; and traders taking the aforementioned stance towards trends going into fundamental data releases are doing just that.

Ranges and Breakouts

For traders looking to trade ranges and breakouts, the integration of fundamentals and technicals will be slightly different since no bias is being exhibited going into news and data releases.

However, the motive is much the same: Traders anticipate volatility coming from the news release, and they look to use this to their advantage.

While range traders should remain cautious when going into news releases (since additional volatility could pierce support and/or resistance with which they are using to set their stops), they can still look to take advantage of overreactions to news. The picture below will illustrate with more detail:

Traders in these situations would want to wait for news or data to cause price to go to support and/or resistance – and once a test of either of these levels are put in – could look to buy or sell accordingly.

Once again, the trader would look to ‘react to the reaction,’ of the news release – using their already prescribed technical setup of buying at support, and selling at resistance.

For traders looking to trade breakouts, they can, once again, look to use the reaction to the news event in the center of their trading strategy.

Traders can look to trade breakouts with any of the prescribed mechanisms of support and resistance, with the anticipation that news releases could bring in the wanted volatility to a) trigger into the trade b) move the trade closer to the trader’s profit target.

-- Written by James B. Stanley (Read the original HERE)

5 Things to Watch on the Economic Calendar This Coming Week

Investing.com - In the week ahead, investors will focus on U.S. economic reports to gauge if the world's largest economy is strong enough to withstand a hike in interest rates in the coming months, with Friday’s nonfarm payrolls data in the spotlight.

Elsewhere, in China, market players will be looking out for data on the country's manufacturing sector, amid ongoing concerns over the health of the world's second biggest economy.

Meanwhile, in the U.K., traders will be awaiting reports on activity in the manufacturing and construction sectors for further indications on the continued effect that the Brexit decision is having on the economy.

In addition, Thursday’s euro zone inflation data will be closely watched amid lingering worries over deflationary threats in the single currency region.

Market players will also be looking to Wednesday’s data on Canada's gross domestic product.

Ahead of the coming week, Investing.com has compiled a list of the five biggest events on the economic calendar that are most likely to affect the markets.

1. U.S. jobs report for August

The U.S. Labor Department will release its August nonfarm payrolls report at 8:30AM ET (12:30GMT) on Friday.

The consensus forecast is that the data will show jobs growth of 180,000, following an increase of 255,000 in July, the unemployment rate is forecast to dip 0.1% to 4.8%, whileaverage hourly earnings are expected to rise 0.2% after gaining 0.3% a month earlier.

An upbeat employment report will point to an improving economy and support the case for higher interest rates in the coming months, while a weak report would add to uncertainty over the economic outlook and push prospects of tighter monetary policy further off the table.

Besides the employment report, the U.S. is to produce data on personal spending andincome, core PCE prices, consumer confidence, pending home sales, and factory orders in the week ahead. There is also ISM data on manufacturing sector activity.

2. Chinese manufacturing data

The China Federation of Logistics and Purchasing is to release data on August manufacturing sector activity at 01:00GMT on Thursday (9:00PM ET Wednesday), followed by the Caixin manufacturing index at 01:45GMT (9:45PM ET).

The official China's manufacturing purchasing managers' index is forecast to remain unchanged at 49.9 this month, while the Caixin survey is expected to slip to 50.2 from 50.6 in the preceding month.

Anything above 50.0 signals expansion, while readings below 50.0 indicate industry contraction.

3. U.K. August PMI's

The U.K. will release readings on August manufacturing sector activity on Thursday, followed by a report on the construction sector on Friday.

The manufacturing PMI is forecast to inch up to 49.0 from 48.2 a month earlier, whileconstruction activity is expected to improve slightly to 46.1 from 45.9.

The Bank of England cut interest rates to a record-low 0.25% and launched fresh easing measures earlier in August in a bid to buffer the economy from a downturn following the Brexit vote.

Economic activity in the U.K. is expected to slow down sharply in the second half of the year as businesses face uncertainty over the country’s future direction in wake of the U.K.'s vote to exit the European Union.

4. Euro zone flash August inflation figures

The euro zone will publish flash inflation figures for August at 09:00GMT (5:00AM ET) Wednesday. The consensus forecast is that the report will show consumer prices inched up 0.3%, compared to a rise of 0.2% in July, while core prices are expected to gain 0.9%, unchanged from the prior month.

Slow growth and virtually non-existent inflation will force the European Central Bank to extend and expand the scope of its asset purchase program at its policy meeting later this month, according to a recent Reuters poll of economists.

5. Canadian growth data

Canada is to release GDP figures at 8:30AM ET (12:30GMT) Wednesday. The data is expected to show that the economy expanded 0.5% in June, after shrinking 0.6% a month earlier.

Thursday, 25 August 2016

Wednesday, 24 August 2016

Tuesday, 23 August 2016

Monday, 22 August 2016

Sunday, 21 August 2016

5 Things to Watch on the Economic Calendar This Coming Week

Investing.com - In the week ahead, market players will be turning their attention to a highly anticipated speech by Federal Reserve Chair Janet Yellen for fresh clues on the timing of the next U.S. rate hike.

In addition, investors will continue to focus on U.S. economic reports to gauge if the world's largest economy is strong enough to withstand a rate hike in the coming months, with Friday’s revised second quarter growth data in the spotlight.

Meanwhile, market participants will be looking ahead to a second reading on U.K. growth data for further indications on how business investment and consumer spending performed in the run-up to the Brexit vote.

Traders will also be looking to Tuesday’s survey data on euro zone business activity for fresh signals on the health of the region's economy in wake of Britain's vote to exit the European Union earlier in the summer.

Elsewhere, Japanese inflation data will also be in focus as investors assess the need for further stimulus in the world's third's largest economy.

Ahead of the coming week, Investing.com has compiled a list of the five biggest events on the economic calendar that are most likely to affect the markets.

1. Yellen speaks at Jackson Hole

Investors are looking ahead to this week's annual meeting of top central bankers and economists in Jackson Hole, Wyoming, due to take place from Thursday to Saturday.

The highlight will be when Fed Chair Yellen takes the stage on Friday. Speculation is rife that she will use the speech to start the race for a rate hike as soon as September following a recent barrage of hawkish Fed speakers.

The annual Fed symposium has sometimes been used by Fed chairs to make important policy pronouncements.

According to Investing.com's Fed Rate Monitor Tool, investors are pricing in just a 12% chance of a rate hike by September. December odds were at around 46%.

2. Revised U.S. second quarter growth

The U.S. is to release revised figures on second quarter economic growth at 8:30AM ET (12:30GMT) Friday. The data is expected to show that the economy expanded by 1.1% in the April-June period, downwardly revised from a preliminary estimate of 1.2%.

Besides the GDP report, the U.S. is to produce data on new home sales, existing home sales, durable goods orders, weekly jobless claims and revised consumer sentiment numbers.

3. U.K. Q2 GDP - second estimate

The Office for National Statistics is to produce a second estimate on U.K. economic growthfor the April-to-June quarter at 08:30GMT (4:30AM ET) on Friday. The report is forecast to confirm the economy grew 0.6% in the three months ended June 30, unchanged from a preliminary reading.

However, the bigger question is about third quarter, post-Brexit, growth prospects.

4. Flash euro zone PMIs for August

The euro zone is to publish preliminary data on manufacturing and service sector activity for August at 08:00GMT (4:00AM ET) on Tuesday, amid expectations for a modest decline.

Ahead of the euro zone PMI's, France and Germany will release their own PMI reports at 07:00GMT and 07:30GMT respectively.

Meanwhile, a report on August German business sentiment will also be in focus, with the Ifo research institute slated to release its findings at 08:00GMT (4:00AM ET) on Thursday.

5. July Japanese inflation data

Japan's Statistics Bureau will publish July inflation figures at 23:30GMT Thursday (7:30PM ET). Market analysts expect the headline figure to remain negative, falling 0.4% year-on-year, which would be the eighth straight month of declines.

The country has been struggling to hit its 2% consumer price target, maintaining pressure on policymakers to support the world's third largest economy.

Saturday, 20 August 2016

Pick-Of-The-Day: Weekly Performance Report (15.08.2016 - 19.08.2016)

Scope : Daily Financial Market Analysis

Method : Fibo TuPai 618 Analytics System

Feature : Pick-Of-The-Day

Method : Fibo TuPai 618 Analytics System

Feature : Pick-Of-The-Day

- Monday (15.08.2016)

- Portfolio/ Asset Class : EUR/JPY

- Result : Profit 35 pips

- Tuesday (16.08.2016)

- Portfolio/ Asset Class : USD/JPY

- Result : Profit 63 pips

- Wednesday (17.08.2016)

- Portfolio/ Asset Class : No issuance in relation to upcoming US FOMC minutes release

- Result : N/A

- Thursday (18.08.2016)

- Portfolio/ Asset Class : USD/JPY

- Result : Loss 19 pips

- Friday (19.08.2016)

- Portfolio/ Asset Class : AUD/USD

- Result : Profit 37 pips

- Weekly Performance

- Pips-Gain Statistic

- Total Pips Gain : 116 pips

- Total Pips Loss : 19 pips

- Nett Pips Gain : 97 pips

- Total % Nett Pips Gain : 83.6 %

- Analysis Accuracy

- Total Analysis Published : 4

- Total Analysis - Accurate : 3

- Total Analysis - Deviant : 1

- Nett % Analysis Accuracy : 75.0%

- References Link : Please click HERE to view the Trading Journal

Friday, 19 August 2016

Should You Average Down In Trading?

FEATURED ARTICLE

Should you average down in a trade or investment? A big question that many people have. They play place a trade, then it starts moving against them. They then start thinking whether they should average down for long trades, or averaging up for short trades.

After all, if you average down, your average price for the shares lets say goes down. If the average price goes down, then all you need is a smaller bounce back up and you can get to break even or to profit. Sounds seductively amazing?

Only problem is the more you average down, the more of your portfolio and equity in your account is at risk. Any further market moves against you have a much bigger impact because you have increased your position size. Also if the market has moved against your initial position, what makes you so sure that now after you have loaded up on a bigger position that the market will move in your favor. You need to ask the right trading questions. After all the market doesn’t care how big, or small of a position you have. Well, most of the time the market doesn’t care how big of a position you have, but with hedge funds running multi billion dollar positions, sometimes the market does care, but that is for another article.

If you do plan to average down and put on a bigger size than what your risk parameters state, then you should at least have the order flow and liquidity on your side.

Typically trader psychology and money management techniques teach that you should not average down. And for most people this is sound advice as they do not want to blow up their accounts. They want to keep your account near it’s initial value so that when they learn the trading game, they can place the good trades with their full account equity and a not a depleted capital base.

There are however a few, or many exceptions to the never average down rule.

If you have a trading strategy where you clearly define that you will use a scaling in type entry strategy, then averaging down or up is perfectly normal. This is assuming you have clearly positioned size to reflect this trading strategy.

If you have clearly defined what your position size will be at the various entry points, and what your total position size can be for the trade, then you can take no more risk than the other traders who are getting all in at once with one trade.

For example.

Let us say that you determined on April 26, 2011 that the Euro may experience a drop. But you do not know the exact timing of the move, nor what price the Euro will top out at. Thus you do not want to get your full position size in all at one price. You don’t know if the top will occur all in one day. So you decide to prepare a scale in type of short strategy where you start selling EUR/USD every 100 pips. You start building up a short position at 1.4700, and start adding every 100 pips to your short. You get in one-third of your position at 1.4700, another one third at 1.4800, with the final one third position at 1.4900. Lets say you have a stop loss for all the positions at 1.5050.

Let us say that you have an account size of $100,000 and choose a maximum of 3 standard contracts as your full position size. So you sell 1 standard contract at 1.4700, followed by one more short contract at 1.4800, followed by the last short contract at 1.4900. You have achieved your full position size of three standard contract, but you have scaled into the short position. In other words you have averaged up.

In the above chart, I have shown the potential scale in strategy you could of used in the Euro.

If you had a $100,000 account and traded 3 standard contracts you would of:

- Shorted 1 standard contract at 1.4700

- Shorted 1 standard contract at 1.4800

- Shorted final 1 standard contract at 1.4900.

- Stop loss at 1.5050 lets say

Total risk for the trade if all three standard lots got stopped out at 1.5050 would be a $7,500 dollar loss.

Now contrast this with the other type of trader who just likes to get in the full position all at once. Lets say the same trader made the decision on April 25 that the Euro should go down. They choose not to use a scale in strategy. They should to just short 3 standard lots all at the 1.4700 price. They too risk $7,500 so their stop loss would be at 1.4950. In this particular market scenario the stop loss almost got hit.

Now in the end both types of traders still made money, but the scale in trader made more money because they got in some of their short positions at higher prices, while the all at once trader shorted the full position size at the 1.4700 level.

There isn’t anything wrong with either the scale in or all at once approach. Both of those entry techniques can benefit from having better market timing.

Don’t let anyone tell you that averaging down for long trades or averaging up for short trades is a bad strategy. It can be completely viable if you have positioned size for the scaling in of the positions and still control your risk. The people telling you that you should not practice averaging down probably have very little knowledge about scaling in and position sizing.

======================

Read the original HERE

Subscribe to:

Comments (Atom)